|

|

Industry Manufacturers Upbeat About 2010 This year will definitely go down

in the history books. Many are already calling 2009 the worst recession since the great depression of the

‘30s. Although the automotive specialty equipment industry typically is impervious to economic swings,

the last two years have had a definite negative impact. In August, Fast Lane Research

conducted a survey of more than 2,600 industry manufacturers and found that 65% were experiencing sales that were less than

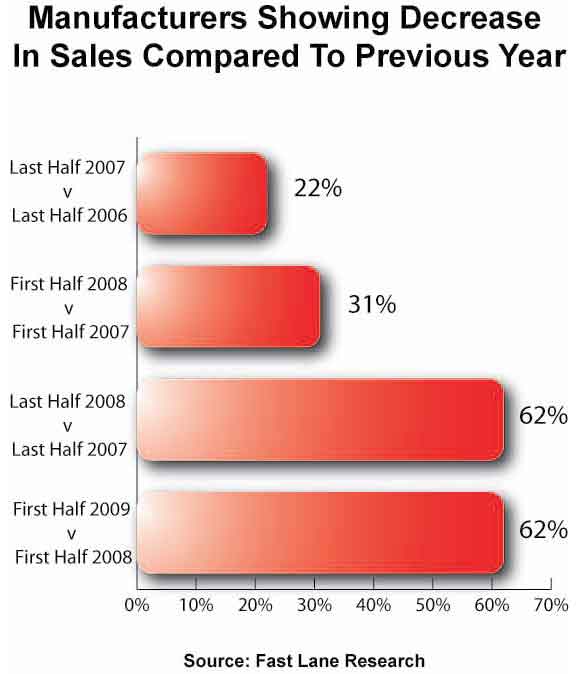

the year before. Based on manufacturers’ responses, the slide began in the last half of 2007 when

22% had sales less than 2006. The spiral accelerated to 31% of respondents with decreased sales in the

first half of 2008. Then in the last half of 2008 and the first half of 2009 the percentage of companies

with sales below the previous year increased to 62%. This is a trend the industry is not accustomed to. In fact, this is only the second time in more

than 25 years of recorded industry sales data that there has been negative sales growth—the first was in 1991 during

the first gulf war. What’s worse is this is the first time there have been two consecutive years

of decreased sales for the industry. When we asked manufacturers how they expected the automotive specialty

products industry to do in 2009, 57% indicated that industry sales would be less than 2008. Another 30%

of responding manufacturers expect 2009 to be about the same as last year, and 13% expect to see and industry wide increase. The good news is that these same manufacturers

are expecting the industry to make a comeback in 2010. When asked what change they expect next year in

the automotive specialty equipment market, 56% said that based on what they know of the marketplace business will be in positive

territory again. If these people are right, and who should know better than they, we are seeing the light

at the end of the tunnel (and it’s not an oncoming train!).

|

|||||||||||

|

Enter supporting content here |

|||||||||||