|

|

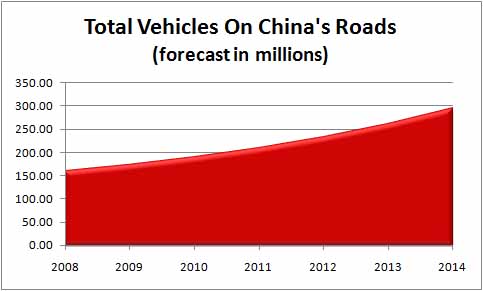

China Automotive Population to Match US by 2013 Total

light-vehicle sales in China for 2009 were 12.7 million compared to 10.4 million in the US. Those new-vehicle

sales add to an already growing vehicle population that will soon surpass the US.

In 2009 new-vehicle sales

in China increased of more than 44% and set a new record in unit sales with an estimated 13.6 million light and heavy vehicles.

Of that 10.3 million were passenger cars and 2.4 million were light trucks. At the same time US

new light-vehicle sales dropped 21%. Some of the automotive sales growth in China is due to the $586 billion

in government stimulus. The

new vehicle sales projection for 2010 in China is an increase of 20% according to a well placed Chinese official.

In comparison, JD Power is forecasting a more conservative increase in the 7% range. Either way,

to have an increase of any size following a 45% run-up is amazing. Expect to see US automakers move the

Chinese market up in their priority lists. With GM and Ford reporting sales growth of 67% and 44% respectively,

there has to be increased attention to the market to offset market losses in the US. China New Vehicle Sales Trend Year Units % Change 2009 13.6 44.7% 2008 9.4 8.0% 2007 8.7 24.3% 2006 7.0 20.7% 2005 5.8 Not all of these vehicles are passenger cars and light trucks, but it gives you a sense of how quickly the market

is growing. In 2009, 12.7 million of the new vehicles sold were cars and light trucks. The question is, when will China be a viable market for performance parts and

accessories. As of Jan 2008 there were 160 million vehicles operating on China’s roadways, compared

to more than 255 million on US roads. If the new vehicle sales trend continues at its current pace it won’t

be long before China has a vehicle population comparable to the US. In fact, if you assume an annual increase

in new vehicle sales of 20% and negligible scrappage, China should have a similar vehicle population as the US by the end

of 2013. That’s only four years from now! Other key parts of the equation are the consumer demographics and attitudes in China about customizing.

The US market for performance parts and accessories has blossomed around a strong middle class with discretionary income,

and a love of cars. Are those same factors at play in China? Many business analysts and economists are saying China is poised for huge growth

in consumer-product sales based on huge increases in the middle class. As with everything in market research,

how you define things makes all the difference in the numbers. If we say that the middle class in China

has an annual income of about $9,000 US, then about 14% of the population is middle class today. If current

trends continue there will be more than 600 million middle class consumers in China by 2015. That’s

nearly double the whole US population today. So

the vehicles will be there and the consumers will be there, but will the consumers be inclined toward customizing?

The short answer is YES! As the middle class in China grows, it is creating a new car culture and

enjoying the freedom that personal vehicles provide. Owning a car in China takes on the status that owning

a TV did in the US back in the ‘50s. Today there are car clubs and tuning shops springing up in the

major cities of China. There

are challenges ahead for the automotive market in China. Issues like soaring pollution and gridlock on

roadways will have to be solved. But the taste of freedom that owning a car provides has already begun

to spread. The final question

is, how long will it take your company to be in position to capitalize on the market in China? If the crest

of the wave does truly begin to break in 2013, do you have enough time to establish the all important relationships necessary

to take advantage of the opportunity? Will your company have all the logistics figured out?

If you are going after the China market,

just don’t wait too long to prepare so you can take advantage of one of the biggest coming opportunities the industry

has ever seen. Don’t think the China market

is for your company? Keep in mind that the aging US population and the recent recession will make company

growth hard to come by in the coming years. The recession has wiped out more than 10 years of industry

growth in the US, and has impacted consumer spending patterns going forward. Companies that focus only

on the US will be locked in share wars for the existing market. |

||||||||||||||||||